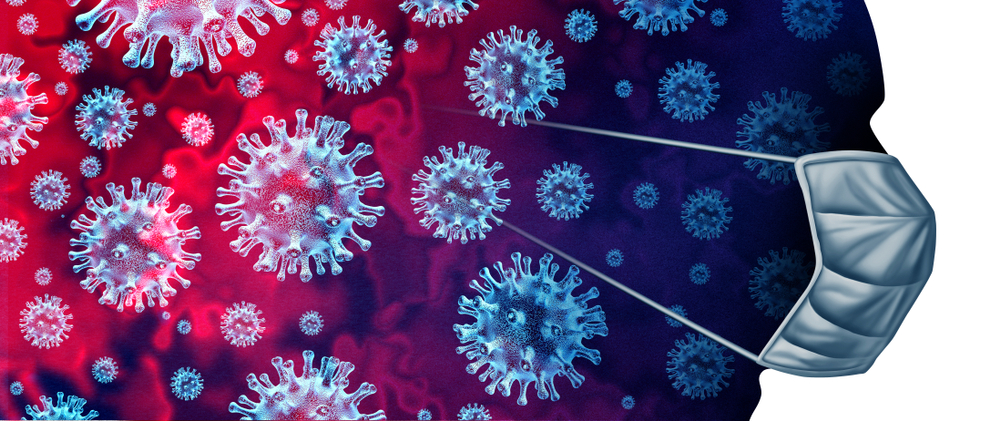

Pink Finance is here to support our clients by providing guidance, useful links and information to help you navigate the Covid-19 situation and its impacts. We discuss four options that banks are providing to help assist you with your home loan repayments, if you are facing financial stress or hardship due to Covid-19. With our unique Covid-19 modelling calculator we can provide you with individual analysis of your loan and modelling for your situation.