As the world comes to terms with the unfolding COVID-19 situation and we get used to the ‘new normal’, I wanted to let you know we are committed to helping our clients at Pink Finance through what will likely be very hard and challenging times ahead.

We have had many calls over the last few weeks requesting financial support and guidance, assisting our clients who may have lost their jobs or had their hours reduced and are needing mortgage relief over the coming 3-6 months.

Firstly, the good news for everyone is the banks are providing a lot of different options that can be tailored to each individual case. Let’s go through a few of the options:

1. Reduce your payments and use your redraw or offset account to make up the shortfall in repayments – this is the best outcome as your loan term or your repayments are not impacted

2. Switch from P&I to IO – if you do this for 6 months – the option at the end, depending on the lender will be to increase your loan term by the months that you went to IO, or the repayment will increase to cover the 6 months of principal that was not paid down so you are playing catch up on that principal

3. Nominate an amount you can afford to pay

4. Repayment pause or ‘payment holiday’, not as glamourous as it sounds, as it is more interest capitalisation which will certainly add to your loan balance

One of their preferred options is 2) changing your mortgage from Principal and Interest (P&I) to an Interest-Only (IO) option. This then reduces your repayment options over 3-6 months giving you more cash flow temporarily.

Another option being widely touted by a lot of the press is option 4) a ‘payment holiday’ which freezes your repayments during this period but extends the life of your loan by 3-6 months. This is in effect ‘interest capitalisation’ and adds unpaid interest to the principal balance of your loan. Although it gives you more cash flow in the interim you have compound interest working against you.

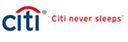

However, every individual is different and each person has various circumstances that are impacting them. We have a modelling calculator that we are now using that goes through the many financial scenarios and we are using it to provide individual analysis of your loan and modelling for your situation. We can see whether moving to interest only, ‘payment holiday’ or a hardship scenario affects your loan balance, the interest you have to pay and maturity dates of your loan.

An example of the four different options on a $600,000 mortgage with an interest rate of 3.04% is shown below.

To help you navigate the COVID-19 situation and the impacts it might have on your job, business or mortgage we have pulled together some useful links and information.

If you run a business there are a number of national and state-based government initiatives that are now in place to help:

- Small Business Support

- Sole Trader Support

- Temporary relief for financially distressed businesses

- Increasing the instant asset write off

- Coronavirus and Australian workplace laws

If you have lost your job

- Individual affected by the coronavirus

- Lender hardship contact details

- Making financial decisions

- Early access to superannuation

- Fair Work Ombudsman

We are here to help you and support you especially in these unprecedented and uncertain economic times, so please do get in touch if we can assist you.

This month, Pink Finance has been featured on well known and much loved Sydney based business, Tradebusters. Tradebusters are Australia’s first truly vetted, word-of-mouth network of recommended service providers. Established in 2006, their website has helped thousands of homeowners have trustworthy experiences with honest, local tradesmen and businesses. Their business motto says it all, ‘We don’t do dodgy’!

Within their brand, which includes an online directory and personalised tradesmen concierge service, each month they choose 3 businesses to be featured on their ‘Top 3 Local Business Picks.’ These businesses are selected from their local, vetted, word-of-mouth service provider directory.

Some great news for those seeking to obtain finance this week. Independent financial regulator APRA has recommended to the banks that they ease their assessment rates in order to help the contracted lending market.

This is very good news for everyone who has a home loan and it is without a doubt going to help first home buyers get into the property market. I am very happy to hear of this policy, especially after the ongoing restrictions over the past few years.

What is an assessment rate?

It’s a Bond, Deposit Bond.

So you have found a property you want to purchase, but you face a dilemma:

Your savings are locked in a term deposit or are tied up in the equity of your property.

How do I purchase a property when I cannot access my cash?

A simple solution to this may be to have a Deposit Bond.

Deposit Bonds are an insurance policy that indemnifies (or guarantees) that you, the buyer, will have the deposit available at settlement.

There are two type of deposit bonds:

- A Short Term Bond or

- A Long Term Bond

Different criteria apply for short-term and long-term deposit bonds.

A Short-Term Deposit Bond, also known as a Finance Backed Deposit Bond can last for 6 months.

If you have formal finance approval and your loan plus your available savings is equal to or greater than 105% of the purchase price, a Short Term Deposit Bond can be issued without having to assess your borrowing capacity.

A Long Term Deposit Bond will require a full assessment of your position to determine your borrowing capacity. This is commonly used when buying off the plan and you are needing a deposit bond to exchange.

How much does a deposit bond cost?

The costs for a bond vary. The longer the bond term is, the higher the premium will be.

Contact Us if you would like a quote for a deposit bond – it will only take 2 minutes.

All we need is the purchase price and when will settlement be.

Deposit Bond PROS

- Quick turnaround time

- Saves you from having to withdraw investments prematurely

- You can have a blank bond (i.e not property specific) as a way to exchange at auction

- Valid for six months for short term and four years for Off The Plan

Things to be aware of with deposit plans:

- Not all vendors will accept a deposit bond

- You must have written consent in the contract that you can exchange by deposit bond

- Typically the deposit bond will be 10% of purchase price

- If your bond is less than 10% of the purchase price, you may need to use savings to complete the exchange.

- Some lenders will only allow deposit bonds from certain providers.

Pink Finance’s provider of Deposit Bonds is QBE – one of Australia’s biggest insurers.

Having no available cash to exchange is no longer any limitation for you – let Pink Finance help you secure that home today!

When thinking of relocating, either to downsize, upgrade or to move interstate, a question often asked is:

“Do I sell first then buy or do I buy first hope I sell during my settlement period?”

Bridging finance may be an answer to this.

But, what exactly is Bridging finance?

Bridging finance is a loan structure that allows you to fund your new purchase whilst selling your current home. Bridging finance, often called ‘relocation loans’, last between 6 to 12 months time, depending on the lender.

There are three types of debt that is referred to with Bridging finance:

Peak Debt

Where the total debt that you are holding whilst this includes:

- Your current loan balance

- Purchase price of new property (less deposit paid)

- Stamp Duty

- Interest of bridging period

End Debt

The loan balance after the sale of the property and all costs have been paid

No End Debt

Your debt is nil after the bridging period. This is quite common if you are downsizing.

‘How much is bridging finance?’

This is the biggest question we are asked.

Bridging finance used to have a premium rate and was quite an expensive option. Now, Bridging Finance is subject to the standard variable rate. After settlement this will be reduced based on the lender and discount offered and the loan amount.

What are the PROS?

- It enables you to buy the house you love now and saves you possibly moving twice

- Gives you 6 to 12 months to prepare your home for sale to achieve maximum price possible

- Reduced interest only payments or sometimes no payments at all during the bridging period with the flexibility of making extra repayments with no penalty any time

- Rates and no longer inflated

And the CONS?

There are some points to be aware of during the Bridging finance process, so please make sure you consider the following:

- Interest rate accrued on PEAK debt during bridging period

- Higher application fees and valuation costs (some lenders my charge for an extra valuation)

- Limited lenders – not all lenders offer bridging finance. Consulting a broker is a must

- Some lenders will assess your borrowing capacity on your peak debt which can be quite hard to qualify for.

- Some banks reduce the valuation to allow for a fire sale

- Bridging finance is not uncommon, but can be quite complex, so by having a broker who can talk you through the process and to see if you qualify is crucial.

Luckily, Pink Finance loves this stuff! Get in touch if you’d like to learn more about Bridging Finance.