Pink Finance

As the world comes to terms with the unfolding COVID-19 situation and we get used to the ‘new normal’, I wanted to let you know we are committed to helping our clients at Pink Finance through what will likely be very hard and challenging times ahead.

We have had many calls over the last few weeks requesting financial support and guidance, assisting our clients who may have lost their jobs or had their hours reduced and are needing mortgage relief over the coming 3-6 months.

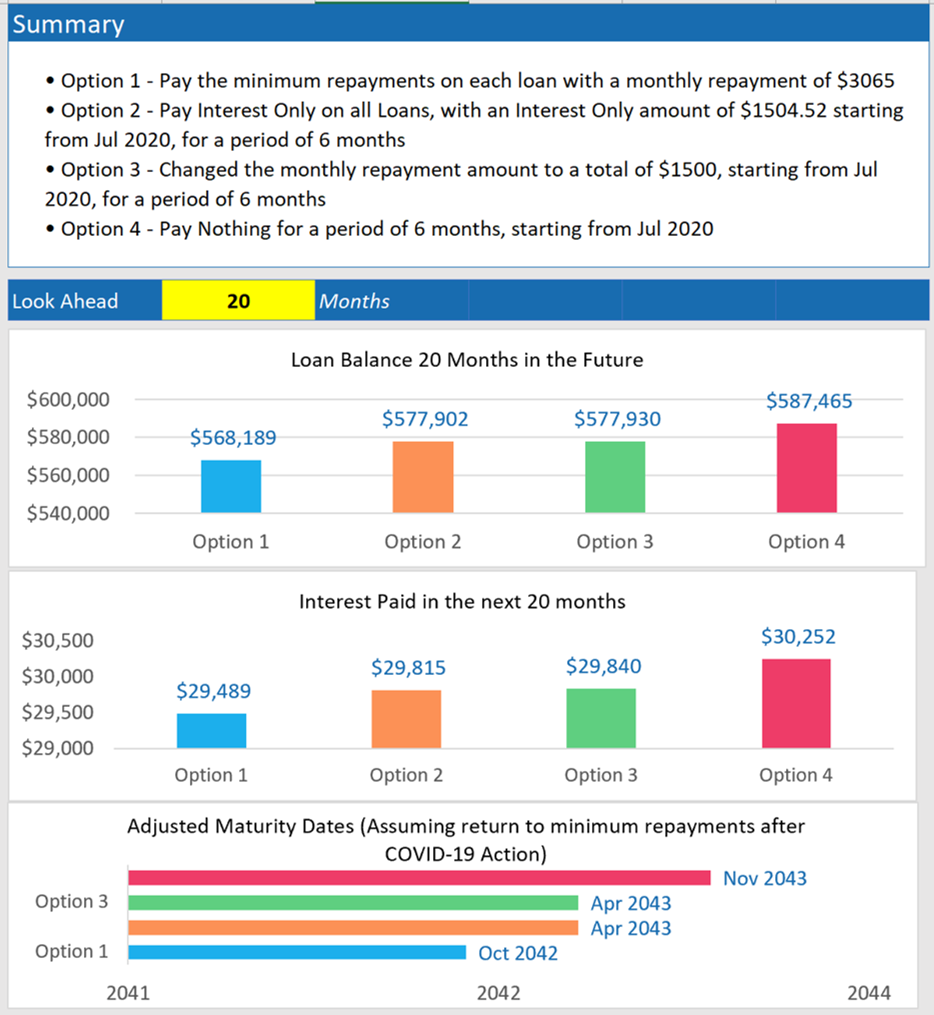

Firstly, the good news for everyone is the banks are providing a lot of different options that can be tailored to each individual case. Let’s go through a few of the options:

1. Reduce your payments and use your redraw or offset account to make up the shortfall in repayments – this is the best outcome as your loan term or your repayments are not impacted

2. Switch from P&I to IO – if you do this for 6 months – the option at the end, depending on the lender will be to increase your loan term by the months that you went to IO, or the repayment will increase to cover the 6 months of principal that was not paid down so you are playing catch up on that principal

3. Nominate an amount you can afford to pay

4. Repayment pause or ‘payment holiday’, not as glamourous as it sounds, as it is more interest capitalisation which will certainly add to your loan balance

One of their preferred options is 2) changing your mortgage from Principal and Interest (P&I) to an Interest-Only (IO) option. This then reduces your repayment options over 3-6 months giving you more cash flow temporarily.

Another option being widely touted by a lot of the press is option 4) a ‘payment holiday’ which freezes your repayments during this period but extends the life of your loan by 3-6 months. This is in effect ‘interest capitalisation’ and adds unpaid interest to the principal balance of your loan. Although it gives you more cash flow in the interim you have compound interest working against you.

However, every individual is different and each person has various circumstances that are impacting them. We have a modelling calculator that we are now using that goes through the many financial scenarios and we are using it to provide individual analysis of your loan and modelling for your situation. We can see whether moving to interest only, ‘payment holiday’ or a hardship scenario affects your loan balance, the interest you have to pay and maturity dates of your loan.

An example of the four different options on a $600,000 mortgage with an interest rate of 3.04% is shown below.

To help you navigate the COVID-19 situation and the impacts it might have on your job, business or mortgage we have pulled together some useful links and information.

If you run a business there are a number of national and state-based government initiatives that are now in place to help:

- Small Business Support

- Sole Trader Support

- Temporary relief for financially distressed businesses

- Increasing the instant asset write off

- Coronavirus and Australian workplace laws

If you have lost your job

- Individual affected by the coronavirus

- Lender hardship contact details

- Making financial decisions

- Early access to superannuation

- Fair Work Ombudsman

We are here to help you and support you especially in these unprecedented and uncertain economic times, so please do get in touch if we can assist you.