There is a lot of excitement about saying YES!

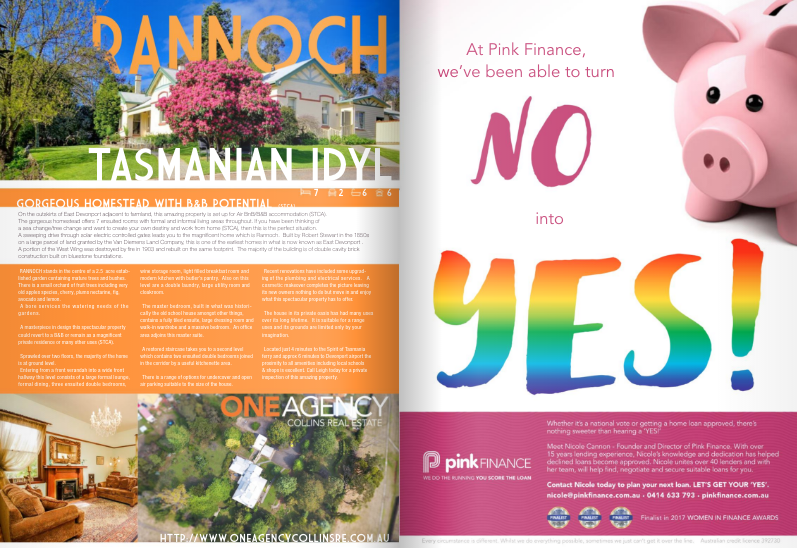

It certainly is a buzzword for many things right now, including marriage equality of which Pink Finance – 100% supports. This is why we partnered with the Star Observer to show how we have turned No into YES!

The Star Observer – October

Nothing is sweeter than being able to call up a client to say CONGRATULATIONS your loan is approved. Sometimes it is not always smooth sailing and there needs to be a second lender involved. There have also been times that a new customer has come to me seeking a second opinion where they have been told no by another.

Have we been able to turn declined loans into approved loans? Yes we have!

Have we misrepresented the application in any way to obtain the loan – DEFINITELY NOT.

Here are 4 current examples of where a no was turned into a YES.

Scenario 1: Rural Block of Land

Mr and Mrs J, are looking to purchase some rural land as a retreat for their three young children on the weekend. They have a 20% deposit. Mr J worked in the mining industry in the WA and was a FIFO (Fly In Fly Out) worker. The broker said the loan was declined due to postcode not being acceptable and concerns over a strike at the mine which was now resolved. This took our client 3 weeks.

Result: Teachers Mutual Bank approved the loan at 80% of land value due to strong income which was evidenced in payslips and employment letter. Approval completed in 10 days.

Scenario 2: Upgrading

Mr H sold his house and purchased a new family home. We had provided loan options and scenarios based on purchase price ranges. Upon successful purchase of property, client went to a big 4 lender who promised a super cheap fixed rate, cheaper than the proposal that we had originally provided. We could not match this rate and accepted we may have to step down on the scenario.

One month later Mr H came back and said that the loan did not get approved and the offer did not proceed.

Result: Loan Conditionally approved subject to valuation only in under 24 hours. Client was relived due to being committed to the property.

Scenario 3 – Debt Consolidation

Mr and Mrs P had considerable personal debt which they wanted to consolidate to improve overall every day cashflow. The restructure was going to save them over $4,000 / month!

Loan was approved but valuation came back with security being unacceptable until some repairs had been completed. A second lender was approached who approved the loan and has accepted the current state of the property and is funding the repairs that need to be done.

I felt compelled to comment and share my thoughts following the ABC 4 Corners Program on 21st August.

This broadcast was grossly negative on our industry, the property market and unethical / bullish practices from brokers and lenders. Whilst I do not disagree about the concerns about increasing home prices, (more…)

We’re over the moon to have been announced as Finalists in the 2017 Women In Finance Awards!

The Women in Finance Awards is an exciting program that identifies the leading women across financial services, from business leaders and mentors, to skilled investment managers, to client-centric accountants, financial advisers and mortgage brokers.

With 28 categories spanning this energetic industry, we are so pleased that we are Finalists in not just one, but THREE categories:

- Mortgage and Finance Broker of the Year

- Principal of the Year

- Womens Community Program of the Year

Each of these categories is special to us, and we’re energised that they each so closely represent our core values at Pink Finance – outstanding service, the sharing of knowledge and our dedication to helping our community.

Winners are announced in late September.

If you’d like us to help you with your next big dream, get in touch today.

“Look at what you have done…

You have changed my life!!!!”

These magical words, the moment where tears and goosebumps were endured by both parties, the realisation that their first Australian home has F.I.N.A.L.L.Y been purchased. After 15 years in the industry it is still so joyous when you can have such an incredible impact on someone’s life goals. After securing the property, considerable time was taken to nut out the best structure between fixed and variable for our clients specific and personal situation.

Sometimes it is just the tiniest of tweaks but it’s the detail that is so important for some of our clients. “… AND it is affordable!!!!!!! ”

BAM!!

That penny-dropping moment that we worked out the perfect structure.

It’s these moments that I cherish with my customers at Pink Finance and it is what we strive for each and every time. “Every Dollar Makes a Difference” – no matter how long it takes, it is so important to have clarity and assurance that your structure, repayments and any other questions you may have are answered.

It is not just your first home that is overwhelming when it comes to the figures. It can absolutely be overwhelming when it comes to refinancing / debt consolidation / renovating / upgrading or investing. Having a broker and team that is with you to step you through the way, now more than ever is so important. Your team needs to be there to step you through the process. Whatever it takes – the extra graphs, explanations, or just a little counselling to make sure you are OK, this is what we just love to do so we can help you achieve your dreams.

We Do the Running, You Score the Loan.

The Budget: Summaries, thoughts and opinions…

As a small business owner that revolves around housing and finance sector, the budget is always of interest to me. This year, with housing affordability a real concern, speculation over negative gearing and the issue of supply and demand with housing I was even interest in this a little more this year! (who would have thought!)

After watching the budget last night and then attending the NAB Budget Breakfast Review the morning after I thought I would share my thoughts and opinions on the areas that matter to my clients, Pink Finance and myself personally.

Overall, I think this budget has merit and is true to their tag line “Fairness, Opportunity and Security”

If you are an up-and-coming First Homebuyer, current or soon-to-be investor or a now ’empty nester’ considering your next move, read on.

First Home Buyers Super Saver Scheme

This was the big new policy change coming into effect from July 1st 2017 providing the ability for first home buyers to salary sacrifice savings into super – this is up to a maximum of $15,000 per year and $30,000 in total.

This is good for the following reasons:

- Tax incentive to save

- Creates an interest / awareness of super as many younger generation pay no or little attention to super

- This can be pooled and not limited per household. i.e. a couple can both take advantage of the salary sacrifice allowing for $60,000 savings to have a tax incentive

- You can’t just easily access the money in savings – it’s locked away for the intended purpose.

- When comparing average superannuation returns to that of an online savings account, the rate of return on your investment should be better

- The gains from the salary sacrifice investment can also be used for the deposit.

In essence, I think this is a good policy. The only downside to this I can see is for those in capital cities and in particular Sydney. On a $600,000 property where stamp duty is $22,490, there is still a lot more savings required for the actual deposit especially if you are doing this solo however it is a start……

I would have liked to have seen, again in the Sydney area, a change to the price ranges of the FHOG. Apartments in the Northern Beaches, North Shore Eastern Suburbs, Inner West very rarely qualify for the FHOG Grant & / or its stamp duty benefits due to property prices shooting through. However not to be.

Property Investors

I was keen to see what the outcome was going to be on this one – investors account for 40% of Pink Finance’s portfolio and I was to see where the policy changes were to be.

There was no direct change to Capital Gains Tax or Negative Gearing – there were some policy changes about what can be claimed and I guess are the areas that were abused and taken the most advantage of so I think this is a happy compromise. So, what specifically were those policy changes?

- No more claiming of travel expenses to go and visit your investment property

- No claiming of depreciation on fixtures and fittings unless you as the investor have purchased those fixtures and fittings yourself.

The cheeky Aussie in me would say “Nawww C’mon” but in reality it is good policy.

Not that I would know about it, *wink* but perhaps personal holidays were scheduled around property inspection visits. How much of this trip was focused specifically on the investment property? In reality, if you have a good property manager you should not have to go and inspect your investment property. This will save the government $480 million over the next 4 years

The abolishment of depreciation of fixtures and fittings for existing properties means that you can only claim depreciation if you have bought this yourself. Nothing changes if:

- Buying Brand New Property

- Purchase a House and Land package

- Renovate an existing dwelling

- Purchase / replace specific items yourself

What this policy is doing is eradicating the duplication of depreciation on established dwellings. For example, you made some renovations and you claimed the depreciation of the renovations, say $10,000. You sell the property and the new purchaser, also an investor, goes to depreciate those items perhaps $6,000 worth – this is double dipping of the depreciation.

Total savings to the budget with these two measures is $1.4 billion.

I am really glad to see that the biggest component to negative gearing being interest and depreciation on new dwellings remain unchanged. So, I guess is fair play.

My take out from this is, for investors, either buy brand new OR buy a property that you could do a small amount of renovations to (bathroom / kitchen) so you can maximise depreciation.

Another massive issue for the budget is supply and demand of housing and this is apparent in so many different sectors of the housing market.

- People living in their family homes over and beyond the children moving out which means less movement of housing stock for younger families

- Housing developments a moving further and further away from the CBD and central places of work

- Infrastructure to support growth

An interesting policy out of this was the incentive for over 65 empty nesters to sell the family home and granting a $300,000 non-concessional contribution to superannuation. The intended outcome of this will be for more property stock to come onto the market for young, growing families to move into. The lack of stock has been a big driver of property price increases.

What I am glad to see is that this new incentive is in addition to concessions already permitted and will be exempt from the age, work and $1,600,000 super balance test. One this to note is you must have lived in this house for 10 years to be able to qualify for this benefit.

More crown / government land will be sold off for development and housing and a focus on affordable housing. There is consultation with cities around the globe how to create little micro cities for smaller dwellings ….. will be interested to see the outcome of this. we struggle with banks’ lending to studio units let alone micro dwellings. (Don’t get me started on this topic!)

There is significant investment in infrastructure, especially in Sydney which (hopefully) will help with the congestion issues we see today.

Other areas of interest to me in the budget were:

- Commentary on the 0.06% Bank Levy …. Which will generate $6,2 billion revenue

- Australia’s AAA Credit Rating

- RBA’s outlook

Obviously, the big banks will not be happy with the tax that has been imposed on the big 4 and Macquarie Bank. Initially my reaction will be that these major lenders will pass on those costs to consumers. However as it is only limited to 5 institutions (NAB, ANZ, CBA and therefore Bankwest, Westpac and therefore St George, and Macquarie Bank) there are many financial institutions to keep competition strong and if they do decide to pass on this cost, then it’s a good time to chat to your broker!!! The theory here is that the competition “should” keep them from passing on the costs. Time will tell here…….

Another critical focus is the AAA Credit Rating that Australia has. We do not want to lose this.

2 out of 3 credit rating agencies response to the budget was they could not see any reason to downgrade. One credit reporting body, Standard and Poor, have the rating as “negative watch”. It, has however been at this for some time and NAB’s thoughts on this is that they anticipate that they will keep the rating as AAA but the commentary continuing as negative watch.

Why is a AAA Credit Rating so important?

In short, it simply keeps the cost of funding down, meaning that we, as consumers, can enjoy cheaper rates. It also shows the strength and integrity of Australia as a country to pay back their debt.

Whilst our household debt is high – and in comparison to many other nations it is high – having lower rates is imperative. The high household debt is a huge concern of the RBA. Australia has an 189% debt to income ratio. In comparison to Canada at 169%, NZ 167% and USA 133% (thanks NAB for the stats!!) This is why the RBA is really focusing on reduction of home loan debt.

This high level to debt ratio is a key reason why the RBA will not reduce rates any more. Nor will they be likely to increase rates anytime soon – the factors that they are closely watching here is inflation (which is very steady and flat at 2%, and also unemployment where this is hovering at around 5.5% mark)

When unemployment improves, in my opinion, this is when we may see the RBA start to focus on increasing rates….. but the banks are doing that for us now anyway!…… but that’s a story for another day!!