As the world comes to terms with the unfolding COVID-19 situation and we get used to the ‘new normal’, I wanted to let you know we are committed to helping our clients at Pink Finance through what will likely be very hard and challenging times ahead.

We have had many calls over the last few weeks requesting financial support and guidance, assisting our clients who may have lost their jobs or had their hours reduced and are needing mortgage relief over the coming 3-6 months.

Firstly, the good news for everyone is the banks are providing a lot of different options that can be tailored to each individual case. Let’s go through a few of the options:

1. Reduce your payments and use your redraw or offset account to make up the shortfall in repayments – this is the best outcome as your loan term or your repayments are not impacted

2. Switch from P&I to IO – if you do this for 6 months – the option at the end, depending on the lender will be to increase your loan term by the months that you went to IO, or the repayment will increase to cover the 6 months of principal that was not paid down so you are playing catch up on that principal

3. Nominate an amount you can afford to pay

4. Repayment pause or ‘payment holiday’, not as glamourous as it sounds, as it is more interest capitalisation which will certainly add to your loan balance

One of their preferred options is 2) changing your mortgage from Principal and Interest (P&I) to an Interest-Only (IO) option. This then reduces your repayment options over 3-6 months giving you more cash flow temporarily.

Another option being widely touted by a lot of the press is option 4) a ‘payment holiday’ which freezes your repayments during this period but extends the life of your loan by 3-6 months. This is in effect ‘interest capitalisation’ and adds unpaid interest to the principal balance of your loan. Although it gives you more cash flow in the interim you have compound interest working against you.

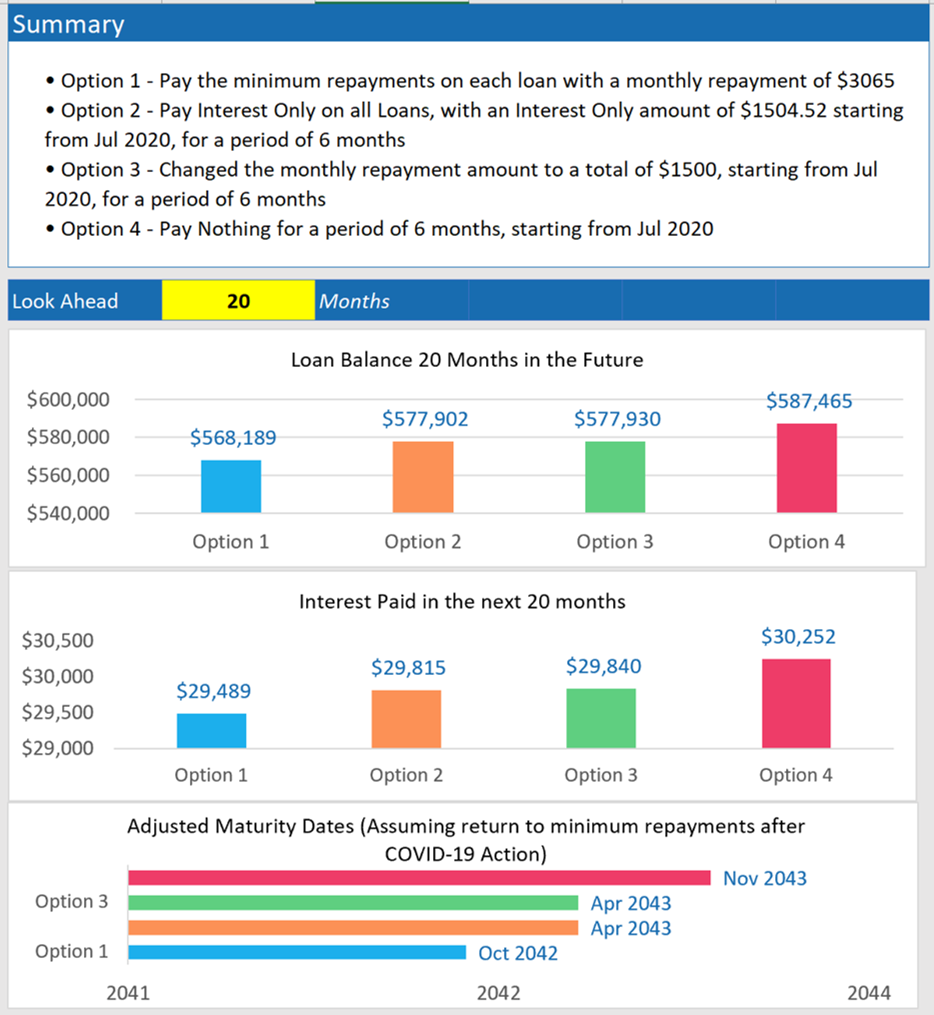

However, every individual is different and each person has various circumstances that are impacting them. We have a modelling calculator that we are now using that goes through the many financial scenarios and we are using it to provide individual analysis of your loan and modelling for your situation. We can see whether moving to interest only, ‘payment holiday’ or a hardship scenario affects your loan balance, the interest you have to pay and maturity dates of your loan.

An example of the four different options on a $600,000 mortgage with an interest rate of 3.04% is shown below.

To help you navigate the COVID-19 situation and the impacts it might have on your job, business or mortgage we have pulled together some useful links and information.

If you run a business there are a number of national and state-based government initiatives that are now in place to help:

- Small Business Support

- Sole Trader Support

- Temporary relief for financially distressed businesses

- Increasing the instant asset write off

- Coronavirus and Australian workplace laws

If you have lost your job

- Individual affected by the coronavirus

- Lender hardship contact details

- Making financial decisions

- Early access to superannuation

- Fair Work Ombudsman

We are here to help you and support you especially in these unprecedented and uncertain economic times, so please do get in touch if we can assist you.

This month, Pink Finance has been featured on well known and much loved Sydney based business, Tradebusters. Tradebusters are Australia’s first truly vetted, word-of-mouth network of recommended service providers. Established in 2006, their website has helped thousands of homeowners have trustworthy experiences with honest, local tradesmen and businesses. Their business motto says it all, ‘We don’t do dodgy’!

Within their brand, which includes an online directory and personalised tradesmen concierge service, each month they choose 3 businesses to be featured on their ‘Top 3 Local Business Picks.’ These businesses are selected from their local, vetted, word-of-mouth service provider directory.

Some great news for those seeking to obtain finance this week. Independent financial regulator APRA has recommended to the banks that they ease their assessment rates in order to help the contracted lending market.

This is very good news for everyone who has a home loan and it is without a doubt going to help first home buyers get into the property market. I am very happy to hear of this policy, especially after the ongoing restrictions over the past few years.

What is an assessment rate?

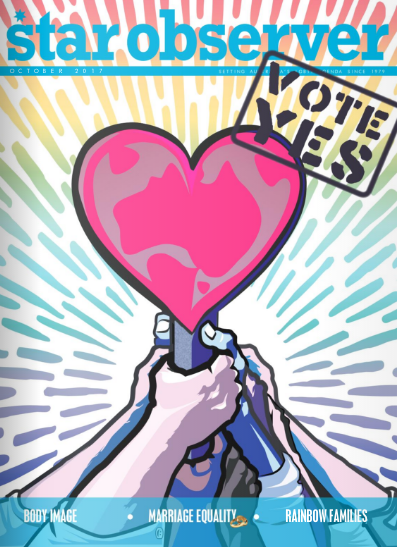

There is a lot of excitement about saying YES!

It certainly is a buzzword for many things right now, including marriage equality of which Pink Finance – 100% supports. This is why we partnered with the Star Observer to show how we have turned No into YES!

The Star Observer – October

Nothing is sweeter than being able to call up a client to say CONGRATULATIONS your loan is approved. Sometimes it is not always smooth sailing and there needs to be a second lender involved. There have also been times that a new customer has come to me seeking a second opinion where they have been told no by another.

Have we been able to turn declined loans into approved loans? Yes we have!

Have we misrepresented the application in any way to obtain the loan – DEFINITELY NOT.

Here are 4 current examples of where a no was turned into a YES.

Scenario 1: Rural Block of Land

Mr and Mrs J, are looking to purchase some rural land as a retreat for their three young children on the weekend. They have a 20% deposit. Mr J worked in the mining industry in the WA and was a FIFO (Fly In Fly Out) worker. The broker said the loan was declined due to postcode not being acceptable and concerns over a strike at the mine which was now resolved. This took our client 3 weeks.

Result: Teachers Mutual Bank approved the loan at 80% of land value due to strong income which was evidenced in payslips and employment letter. Approval completed in 10 days.

Scenario 2: Upgrading

Mr H sold his house and purchased a new family home. We had provided loan options and scenarios based on purchase price ranges. Upon successful purchase of property, client went to a big 4 lender who promised a super cheap fixed rate, cheaper than the proposal that we had originally provided. We could not match this rate and accepted we may have to step down on the scenario.

One month later Mr H came back and said that the loan did not get approved and the offer did not proceed.

Result: Loan Conditionally approved subject to valuation only in under 24 hours. Client was relived due to being committed to the property.

Scenario 3 – Debt Consolidation

Mr and Mrs P had considerable personal debt which they wanted to consolidate to improve overall every day cashflow. The restructure was going to save them over $4,000 / month!

Loan was approved but valuation came back with security being unacceptable until some repairs had been completed. A second lender was approached who approved the loan and has accepted the current state of the property and is funding the repairs that need to be done.